Stripe Alternatives: Credit Card Payment Gateways Without KYC

Explore KYC-free credit card gateways as Stripe alternatives. Withdraw in USDT with ease, plus insights on fraud prevention and legal compliance.

2025-04-150 minute readTips

Share

When running an online business, implementing credit card payments is one of the simplest and most effective ways to boost sales. As of 2025, non-credit card payment methods are gaining increasing popularity; for example, in Asia, QR code-based payments such as AliPay and WeChat Pay have become the de facto standard. Globally, more large companies are starting to accept cryptocurrency payments. However, credit card payments remain the overwhelming majority in online payments, and the sales of e-commerce sites that cannot accept credit card payments will be extremely limited.

However, introducing credit card payments as a merchant comes with various constraints and business risks.

Major providers like Stripe require strict KYC (Know Your Customer) and KYB (Know Your Business) procedures. These are necessary measures for anti-money laundering and fraud prevention, and they also provide reassurance to buyers by verifying the seller’s identity. On the other hand, submitting personal information for KYC/KYB can be a major hurdle for individuals who prioritize privacy or startups lacking creditworthiness.

So, would it be ideal if there were payment providers that allow you to accept credit card payments without requiring KYB or KYC, while preserving the merchant’s privacy?

In this article, we introduce several payment gateways that focus on protecting the privacy of merchants.

Disclaimer: This article introduces payment gateways that do not require KYB or KYC. However, any business accepting credit card payments is legally obligated to process transactions in compliance with the laws of the card-issuing institutions and countries in which the payments take place, and to pay appropriate taxes. Even when using these providers, risks such as chargebacks cannot be avoided.

WATA

https://en.wata.pro/

WATA is a payment gateway provided by SakhaPayments LLC.

To start using the service, no KYB or KYC is required—only a prior review to determine whether your website complies with their regulations. (Like most payment gateways, they do not support high-risk merchants or adult sites.)

Payment Methods Accepted by WATA

- WATA supports payments via MasterCard, VISA, MIR, and more.

Advantages of Using WATA

- WATA’s fee rates are comparable to those of mainstream gateways like Stripe and Square, totaling around 10%–12%.

- Sales made through WATA can be withdrawn in USDT with no withdrawal fee—only the gas fee is deducted.

- WATA’s API is robust and provides rich information. Even if a credit card transaction fails, the API can offer precise reasons, allowing you to present them to the customer and prompt alternative actions, helping to minimize loss in conversion rates.

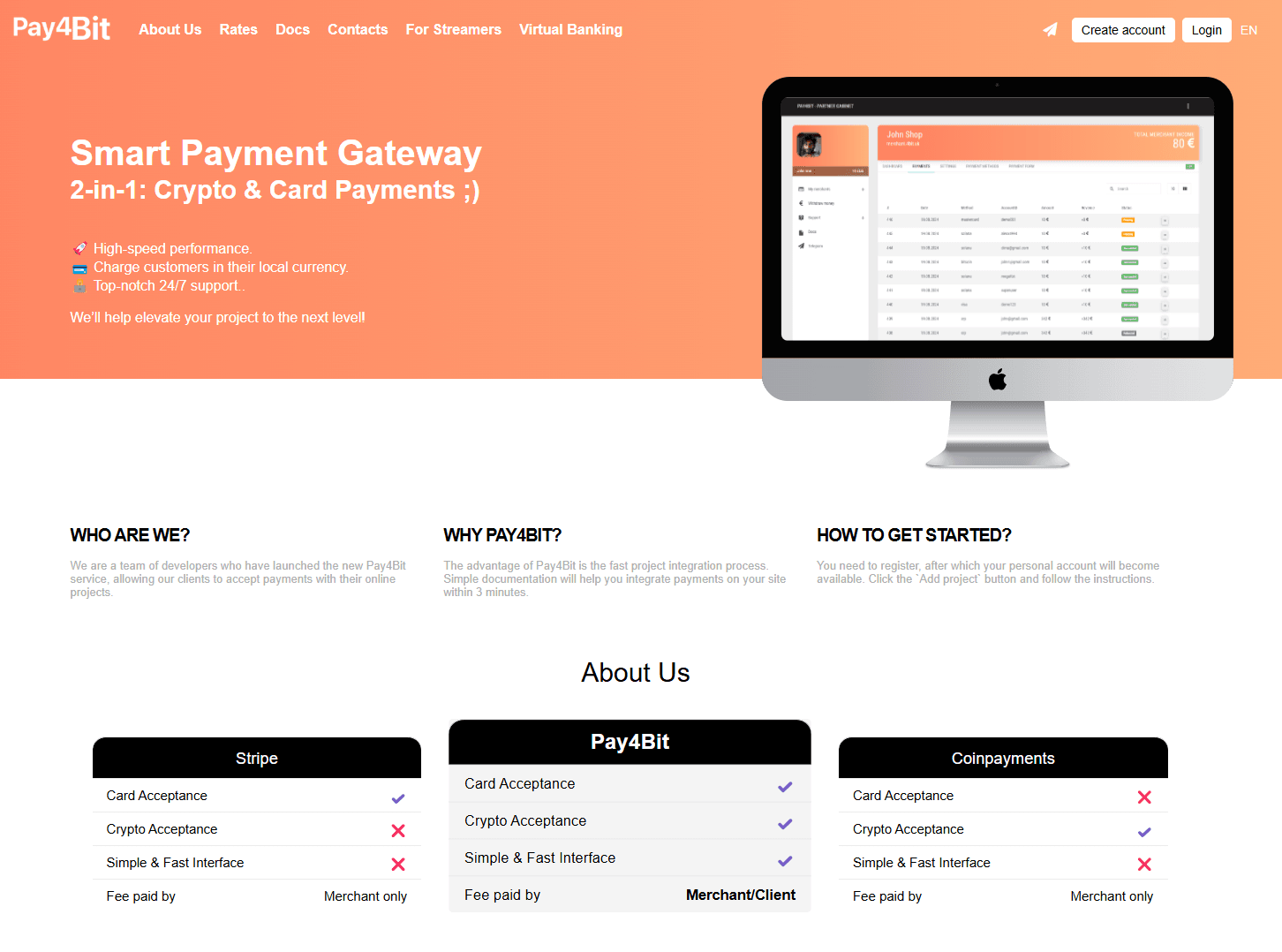

Pay4Bit

https://pay4bit.net

Pay4Bit is a payment gateway provided by Fintechnet Solutions.

No KYC or KYB is required to start using it—only a preliminary review to ensure that your website complies with Pay4Bit’s regulations and AML requirements. The review is typically completed within several minutes to a few hours after submission, allowing you to start accepting payments right away.

Payment Methods Accepted by Pay4Bit

- Pay4Bit accepts multiple credit cards: MasterCard, VISA, AMEX, Diners Card, UnionPay, JCB

- Pay4Bit integrates with Link, Google Pay, and Apple Pay for one-click payments

- Pay4Bit accepts cryptocurrency payments: Bitcoin, Tether (USDT), Tron, Litecoin, Ripple, Solana, Polkadot

- Pay4Bit accepts bank transfer payments: within the US, EU, UK, and Turkey

Benefits of Using Pay4Bit

- Merchants can use the API to build a custom payment form on their own website, or issue a payment URL to accept payments on the Pay4Bit platform

- You can receive payment completion notifications using webhooks

- Merchants can receive revenue via bank withdrawal through SEPA or in USDT

- They update their software frequently and add new features daily

Cost of Using Pay4Bit

First of all, there are no initial or monthly fees to use Pay4Bit. Their revenue model is primarily based on two sources: a small fee of up to €1.5 per sale, and a withdrawal fee ranging from 5% to 10%.

The sales fee is borne by the customer, so there’s no cost to the merchant. However, in the case of a refund, the merchant is responsible for this cost.

Review of Pay4Bit Usage

In fact, our company uses Pay4Bit to accept payments. Their support team is very responsive and usually provides solutions within a few minutes to a few hours.

Their software is continuously evolving, improving its convenience. For example, when we first started using it, refunds to buyers had to be handled manually via support. But shortly afterward, the dashboard allowed us to process refunds ourselves, and now we can even handle them automatically via API.

We did face issues with fraudulent card users at one point, but now a risk-based fraud prevention system has been integrated, and fraud screening problems have significantly decreased.

Points to Note When Using Highly Anonymous Payment Gateways

Anti-Fraud

Using payment gateways like WATA or Pay4Bit allows merchants to accept credit card payments without disclosing excessive business information to customers.

On the other hand, such gateways may have less mature anti-fraud systems compared to major payment systems, so merchants must take sufficient self-defense measures against fraudulent payments. For example:

- Require authentication for credit cards that support 3DS

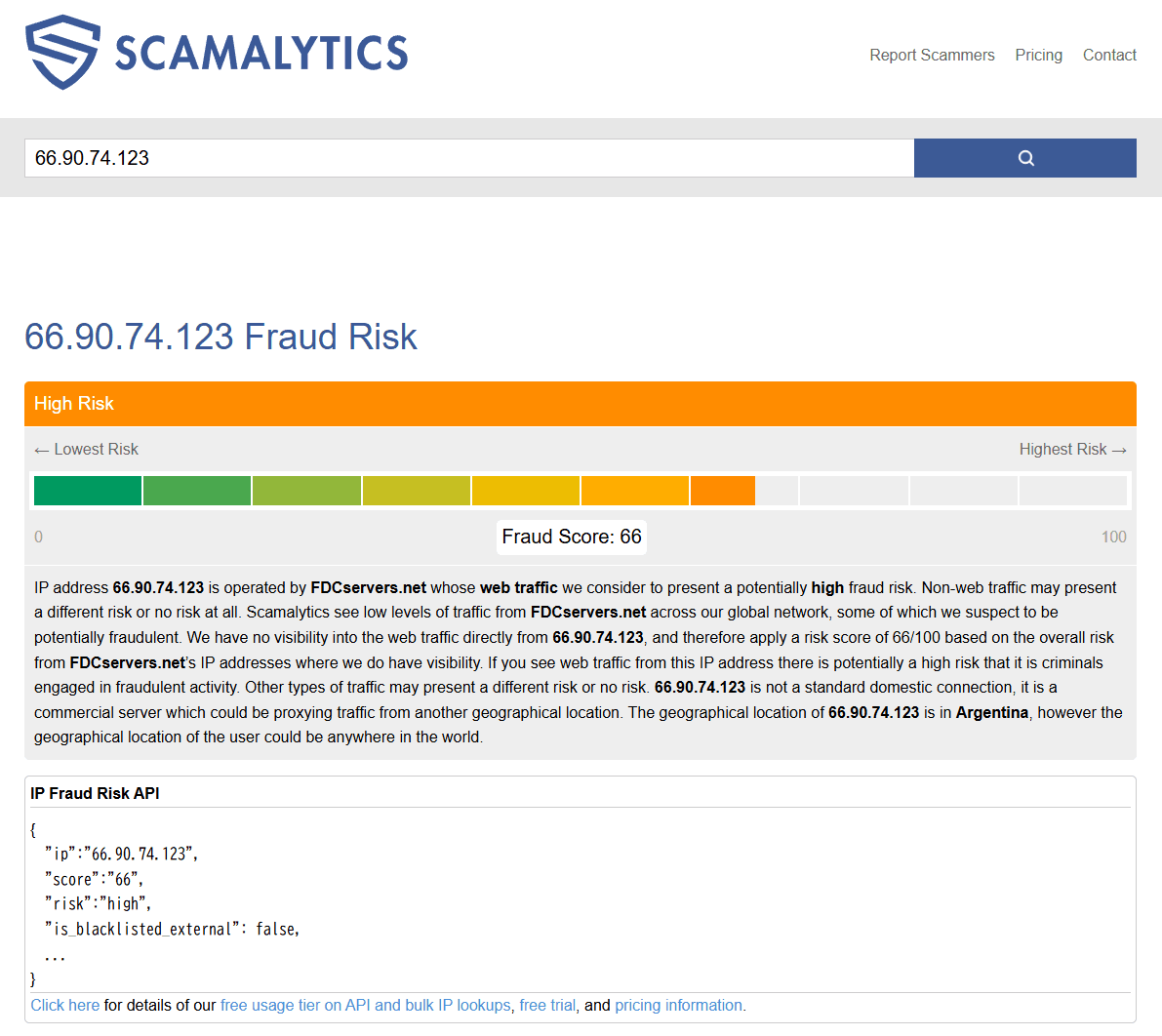

- Use external APIs like Scamalytics to block anonymous access via VPNs, Tor, iCloud Private Relay, etc.

- Collect buyer information before purchase: use KYC SaaS like SumSub to verify that the cardholder matches the user

Users attempting high-risk or illegal transactions often use anonymization tools like VPN or Tor to hide their identity.

Therefore, using services like Scamalytics to assess the customer’s risk level appropriately is important.

Scamalytics scores a customer’s fraud risk out of 100 points. It also provides features to determine whether an IP address belongs to a VPS or server rather than a regular computer, and whether it’s known as an exit node for anonymizing VPNs or Tor.

There’s a risk of false positives for customers who regularly use VPN-style AdBlock tools, but services like these are the first line of defense to avoid transactions with high-risk customers.

Providing Trust to Customers

Even when using payment gateways that don’t require KYC or KYB, you still need to take alternative measures to gain customer trust in your business legitimacy. For example:

- Disclosure of seller information may still be legally required. For instance, in the UK, the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013 mandates displaying details like the seller’s geographic address and contact information. Similar requirements exist in most countries.

- Clearly state the types of information collected about the customer by the merchant and the payment gateway at the time of purchase. Naturally, storing credit card numbers or CVCs is no longer acceptable business practice.

- Clearly display the refund policy.

Payment gateways that can be used without KYC are highly convenient and offer great flexibility, but it's important to remember that using them still comes with responsibilities.